34+ getting rid of mortgage insurance

Call us at 1-800-357-6675 if you have questions about removing your MIP and one of our customer. Web Getting rid of mortgage insurance is a great way to save money on your home expenses.

Comparing Private Mortgage Insurance Vs Mortgage Insurance Premium

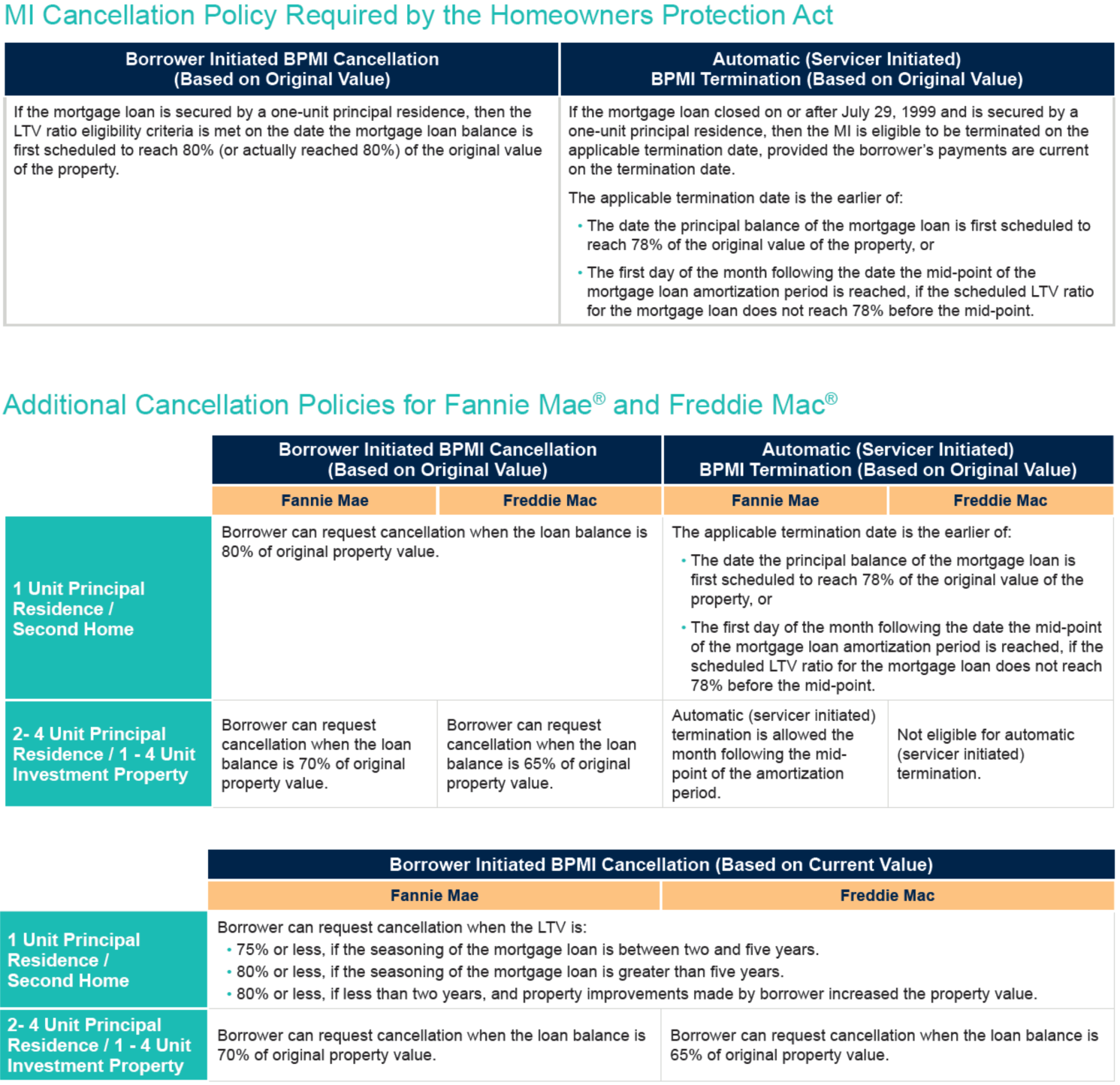

BPMI is an additional fee that youll pay along with your mortgage payment until you have at least 20 equity in your.

. The first option is to simply refinance the loan. You can refinance your loan to get rid of PMI. The rules are different.

If interest rates have dropped since securing your current mortgage then refinancing could save you money. Web Getting Rid of Private Mortgage Insurance. Web Getting rid of PMI does not depend on refinancing.

Web 5 ways to get rid of mortgage insurance faster Luckily its possible to wipe out mortgage expense sooner rather than later. Just multiply your original home. Pay down your mortgage.

If interest rates have dropped since you took out the mortgage then you might consider refinancing to save money. Web If youre looking to ditch your monthly PMI payments here are a few options. Web Amount of your original down payment Your credit score Current loan type Your debt-to-income ratio As a rule you can expect to pay 05 to 1 of your total loan amount per.

Web In 2021 the National Association of Realtors found the average down payment was 12 while for homebuyers ages 30 and under it was just 6. Your loan-to-value ratio LTV and the type of mortgage. Web There may be four ways to get rid of mortgage insurance but they all revolve around two main factors.

Web Thankfully if you want to know what your loan balance will need to be to cancel your PMI you have a much simpler task. Web Applied after June 2013 and your loan amount was greater than 90 LTV. Refinance to get rid of PMI.

Here are some strategies to kick this. Your LTV or loan-to-value ratio. Web Borrower-paid mortgage insurance BPMI.

The mortgage insurance premium does protect you in the event of an unf. Web Your path to removing mortgage insurance depends on the type of loan you have and its mortgage insurance LTV requirements. In order to do this your new mortgage balance must be 80 of your homes appraised value or lower.

Get to where you only owe 80 of your homes value. When purchasing a standard mortgage from a private lender you may be required to purchase private mortgage insurance PMI. Web Unfortunately you cant just get rid of mortgage insurance unless you take certain steps to do so.

It depends on the value of your home equity which lenders might measure using your loan-to-value ratio. Ad Although HARP Has Expired Rocket Mortgage Still Has Other Options You May Qualify For. Refinance to get rid of mortgage insurance.

Work with Americas 1 online lender to lower your payment or consolidate debt.

How To Get Rid Of Pmi Experian

How To Get Rid Of Pmi Removing Private Mortgage Insurance

How To Get Rid Of Pmi Mortgage Insurance 6 Ways To Getting Rid Of Pmi Advisoryhq

Can You Get Rid Of Pmi Sooner Than Planned

How To Get Rid Of Mortgage Pmi Payments Bankrate

How To Get Rid Of Pmi Removing Private Mortgage Insurance

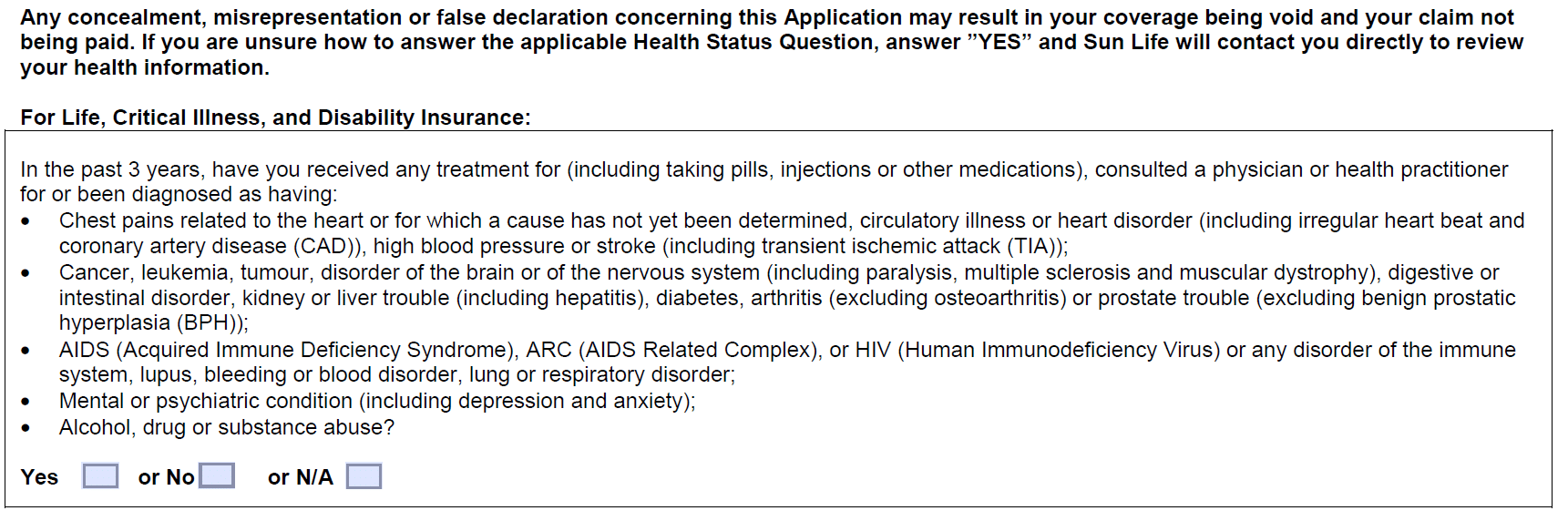

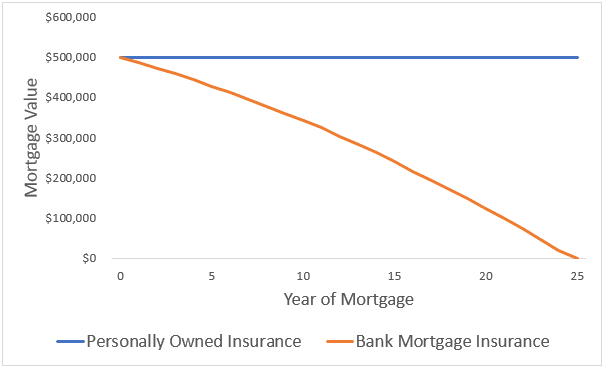

Banks Sell Mortgage Insurance But Independent Experts Say You Shouldn T Buy It National Globalnews Ca

Bni Royal Navan Attention Please Share Calling All Entrepreneurs That Want To Grow Their Own Business Further Bni Royal Navan Are Currently Looking For Professional People In Any Of

How To Get Rid Of Private Mortgage Insurance Earlystephen Shea S Mortgage Report

8 Reasons Why Not To Buy Bank Mortgage Insurance Pharma Tax

How To Get Rid Of Private Mortgage Insurance Earlystephen Shea S Mortgage Report

![]()

Xfhkttlm1rpmym

Real Estate Appraisers Reasons To Hire A Home Appraiser

How To Cancel Private Mortgage Insurance Pmi

Cis Pmi Questions And Answers

How To Get Rid Of Pmi The Insurance Bulletin

Fm 752 Lots 1 2 Rusk Tx 75785 Realtor Com